Are your invoices ATO compliant and suitably branded?

We’ve pointed-out to a few of our suppliers lately that their invoices weren’t compliant with tax invoice requirements of the ATO. So here are a few tips for those of you with small businesses which are registered for GST.

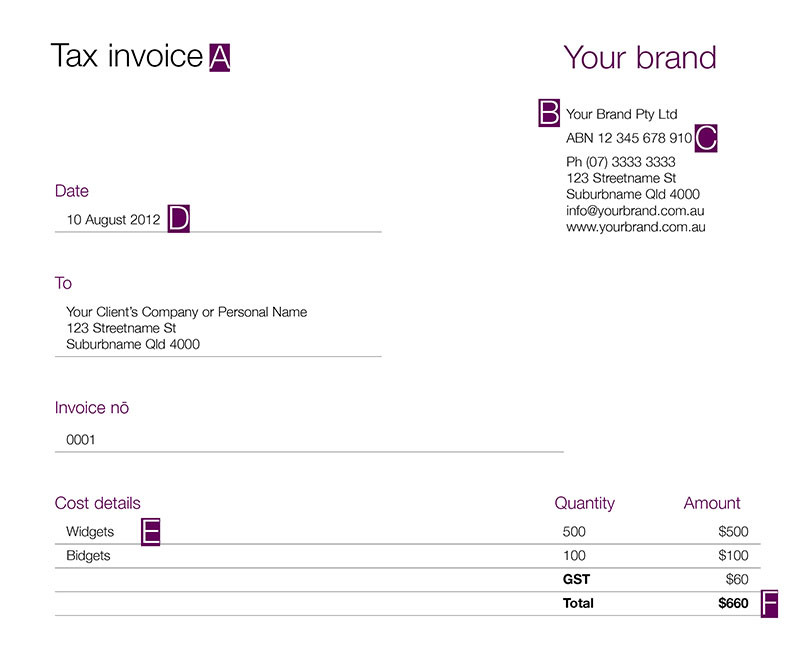

If the tax invoice is for less than $1000 in total

The following information must be included:

- The words “Tax invoice”.

- Your full business or company name.

- Your Australian business number (ABN).

- The date issued.

- Description of goods and/or services sold.

- There are two alternatives for displaying the total and GST:

- The total price of what is sold (including GST) coupled with the statement “Total price includes GST” (if one-eleventh of the total price).

- Show the GST separately, and the total price of what is sold (including GST).

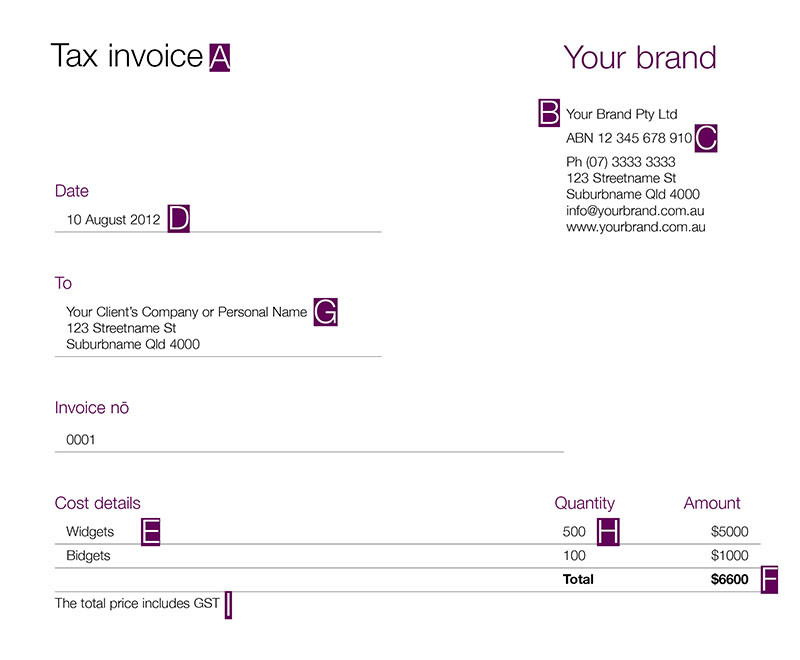

If the tax invoice is for $1000 or more

The following information must be included:

- The words “Tax invoice”.

- Your full business or company name.

- Your Australian business number (ABN).

- The date issued.

- Description of goods and/or services sold.

- The total price of what is sold (including GST).

- The buyer’s business name, company name or personal name.

- The quantity (if applicable).

- There are three alternatives for displaying GST:

- Include the statement “The total price includes GST”.

- Include a sub total which identifies the amount of GST charged.

- Include the GST applicable per unit.

Other considerations

- If you have a mix of taxable and non-taxable sales, or you have any questions about tax invoices, then we strongly suggest you talk directly to your accountant or the ATO about invoicing.

- You should include payment terms and payment alternatives.

- And finally, if you want your invoices to look professional and reinforce your branding, then contact Creative Passion.